|

----------------------------------------------------

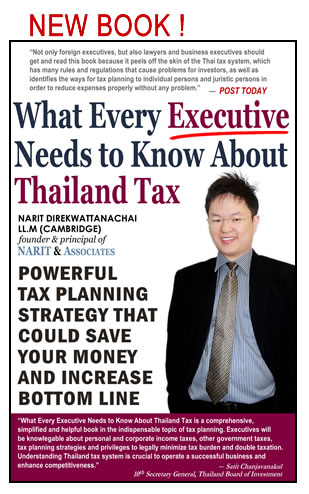

WHAT EVERY EXECUTIVE NEEDS TO KNOW ABOUT THAILAND TAX [Paperback]

Narit Direkwattanachai (About the Author)

----------------------------------------------------

PRICE:

Baht 1,500 & eligible for FREE SHIPPING on delivery in Thailand

PRODUCT DETAILS:

Paperback: 552 pages

Publisher: NARIT & Associates (2011)

Language: English

ISBN: 978-974-496-614-8

Product Dimensions: 24.5 x 16 x 3.2 cm

Shipping Weight: 0.8 kg

FRONT COVER [Zoom +]

BACK COVER [Zoom +]

----------------------------------------------------

TO ORDER BOOK:

1. CALL: +66 2248 2874

(Thailand Time)

2. EMAIL: enquiry@naritlaw.com

|

-------------------------------------------------------------------------------------------------------------------

PRODUCT DESCRIPTION:

Thailand tax rules may seem hideously complex, hard to learn, often leading to

uncertainty and obscurity. Even the finest tax experts sometimes lose in translation,

not to mention executives who are generally non-tax specialists.

This is where executives will find this book their best tax companion. While it is not

an easy task, the book tries to translate the Thailand tax law into an easy to undertand,

practical guideline in plain English. Execuives can save time, energy and resources by

skipping the complexity but focuing more on its practicality. Brimming with in-depth

insights gained from years of practical experiences, this book also shows how to do

tax planning to minimize taxes, which of course would mean more money can be saved.

-----------------------------------------------------------------------------------------------

BOOK PRAISE:

gA book that is interesting to read these days is What Every Executive Needs to Know

About

Thailand Tax written by a young lawyer, Narit Direkwattanachai, a lawyer from

Cambridge, an owner of the law firm of NARIT & Associates. Not only foreign executives,

but also lawyers

and business executives should get and read this book because it peels

off the skin of the Thai tax system, which has many rules and regulations that cause

problems for investors, as well as identifies the ways for tax planning to individual persons

and juristic persons in order to reduce the expenses properly without any problem.h

-- POST TODAY

gThailand is well-known for its liberal policy promoting foreigners to invest and conduct

business. What Every Executive Needs to Know About Thailand Tax is a comprehensive,

simplified, and helpful book on the indispensable topic of tax planning. Executives will

be knowledgeable about personal and corporate income taxes, other government

taxes, tax planning strategies and privileges to legally minimize tax burden and double

taxation. Understanding Thailand tax system is crucial to operate a successful business and enhance competitiveness. It is essential for anyone who wishes to be ready for the advent

of ASEAN Economics Community in 2015.h

-- Satit Chanjavanakul

10th Secretary General, Thailand Board of Investment

gNarit walks us through some tax fundamentals in plain English that all executives should

know. As an attorney who deals with international tax, Narit shares with us insights on

tax aspects of cross border transactionsh

-- Dusit Nontanakorn

Chairman, Thai Chamber of Commerce and Board of Trade of Thailand

gI just finished reading your book and I must say, well done! The ability to take a

complicated concept and break it down to the bare essentials and make knowledge

accessible to the layman is a true gift, and your book does just that! Additionally the style

of writing and diction employed make the read easy and the pages just fly by.

I really

enjoyed reading it and have decided to pass it around the office!h

-- Khalid Hashim

Managing Director, Precious Shipping PCL.

gI had the opportunity to go through your book and find it a very good reference

material for any foreigner planning to start a business in Thailand. I would, also,

recommend this book as well to businessmen or professionals who are staying in

Thailand who need

a good reference book on taxes in Thailand. It is simple to read

and well organized. Congratulations on your fine effort.h

-- Yeap Swee Chuan

Chairman, Malaysian Thai Chamber of Commerce

President & CEO, Aapico Hitech Plc.

gDoing business in Thailand is very difficult for the gfarangh or foreigner. There are

many pitfalls to be careful of including labour, customs, shareholders and others.

Finding good advice on how to address these issues is also very difficult, as it is

more often who you know, or what your position in society is thatfs important

more than the written document, contract, law or regulation.

Even Farangs that have been in Thailand for many years get caught out by customers,

suppliers and employees on a regular basis.

This problem is what makes this book special.

A simple to read and understand guide to the taxation system is vitally important

to help the Farang executive know and understand the many forms and requirements

(most of which are prepared and presented in Thai) that are a necessary part of

business here. It is long overdue and not something that the Thai government would look

to publish anytime soon.

NARIT and Associates have had a long history of connections and experience with

the Australian Chamber of Commerce in Thailand, and indeed many of the expat

communities. The many years of hands on experience coupled with a solid British

Education makes his advice second to none in this area.

This book is a must for any

Farang wanting to start a business in Thailand or even for the long term expatriate

manager/owner who is looking to ensure maximum advantages are gained while

still complying with the letter and spirit of Thai tax law.h

-- Andrew Durieux

President, Australian-Thai Chamber of Commerce

Director, Coverage Ltd.

gI have well received your book What Every Executive Needs to Know About Thailand Tax

and I have read it during this Lunar New Year Holidays. I am very impressed with the

content and the examples that your book has mentioned. Your expertise on Thailand tax,

culture and character of Thai people has provided very appropriate advices to

tax payers, especially executives, financial controllers, CEOs, CFOs, and etc.

I am

delighted to read it because your book has chosen a very simple, plain and conversational language so it is easy to understand and pick up. And I laughed when I spotted some of

your humorous quotes. You have made a bore subject etaxationf easy and vivid.

My company doing the foods export has encountered a VAT problem in 1994. I was fined

6 millions Baht due to my non-cooperation with revenue office. It took me 3 years to pay

back this fine and I was forced to bail me out- all caused by different view or

interpretation of tax. I should have been able to avoid this penalty, if I had received

your book earlier. Your book has enlightened my understanding of Thailand taxation and

I do appreciate your contributions and efforts in publishing it.

h

-- Preston Cheng

Vice President, Joint Foreign Chamber of Commerce in Thailand

Former President, Thai-Taiwan Business Association

gThis book provides a practical framework for understanding Thailandfs taxation, pointing

out any tax pitfalls that everyone should avoid and highlighting what a company can do

to take a full advantage of our tax system. Narit offers us valuable tips in plain English that potentially can save your money.h

-- Dhongchai Lamsam

President, Loxley Public Company Limited

gNarit claims that this book is What Every Executive Needs to Know About Thailand Tax.

I must say it is absolutely correct. This book is clearly and cleverly written in plain English

and explains a supposedly complicate topic like tax law in the form suitable for laymen.

It also employs many real-life examples stories which are very practical and easy to

understand. As a CEO for the past twenty years, I recognize the value of learning about

tax planning described very clearly in this book.h

-- Dr. Charles Cheung

Chairman, Committee on Trade Competition, Thai Chamber of Commerce

Founder & CEO, CyberDict Technology Ltd.

gFor foreign investors and business doing business in Thailand, one of the most difficult

areas to understand and comply with the rule is tax and its system. Since I started

my own business in 1987 in Thailand, it is first time for me to see the book that you

authored this time in plain English.

Yes, it has been true that dealing with government on taxes was dilemma especially for

foreign businessman, rather than local entrepreneurs. So, I believe this book is really

excellent and well composed for foreign business communities to get a clear

understanding of Thailandfs taxation as it provides in English how to address and make

practical approach to complicate topic for layman

.h

-- Ahn Jong-Kug

President, Korean-Thai Chamber of Commerce

gHaving read through the book, I believe it is exactly what the market needs for

newcomers to Thailand. Without going into too much, in depth, detail this book

provides an excellent outline of what is required for businesses which want to know

more about how to manage their own affairs within the Kingdom.h

-- Graham MacDonald

Managing Director, MBMG International

|